From Number to Insights: How Financial Outsourcing Enhances Decision Making

Dhaval Desai - Founder

In the fast-paced and competitive landscape of modern business, effective decision-making is paramount. Every choice made by a company, from strategic investments to day-to-day operations, can significantly impact its success and bottom line. Amidst this complexity, many organizations are turning to financial outsourcing as a strategic tool to enhance their decision-making processes. In this article, we'll explore how financial outsourcing can empower businesses to make more informed and effective decisions.

The Challenges of Decision Making:

Decision-making in finance involves analysing vast amounts of data, forecasting future trends, and evaluating various scenarios. However, many companies face challenges in these areas due to limited resources, expertise, and time constraints. Internal finance teams may be overwhelmed by routine tasks such as bookkeeping, payroll processing, and accounts payable/receivable management, leaving little room for strategic analysis.

Leveraging Outsourcing for Strategic Insights:

Financial outsourcing offers a solution by delegating routine financial tasks to external experts, allowing internal teams to focus on strategic analysis and decision-making. Here's how outsourcing enhances decision-making:

-

Access to Specialized Expertise: Outsourcing firms specialize in finance and accounting, employing professionals with diverse skills and experience. By partnering with such firms, businesses gain access to a broader pool of expertise than what may be available in-house. These experts bring fresh perspectives, industry insights, and best practices, enriching the decision-making process.

-

Scalability and Flexibility: Financial outsourcing provides scalability, allowing businesses to adjust resources according to their needs. Whether it's handling seasonal fluctuations, rapid growth, or specific projects, outsourcing firms can quickly adapt to meet changing demands. This flexibility enables companies to make decisions with confidence, knowing they have the necessary support in place.

-

Data Analysis and Reporting: Outsourcing firms leverage advanced technologies and analytics tools to process and analyse financial data efficiently. They generate accurate reports, dashboards, and forecasts, providing management with real-time insights into the company's financial health and performance. Armed with this information, decision-makers can identify trends, anticipate risks, and capitalize on opportunities more effectively.

-

Cost Savings and Efficiency: Outsourcing financial tasks can lead to significant cost savings compared to maintaining an in-house finance department. By eliminating overhead costs such as salaries, benefits, and infrastructure expenses, businesses can allocate resources more strategically. Moreover, outsourcing firms operate with greater efficiency, leveraging economies of scale and automation to streamline processes and deliver results promptly.

-

Risk Management and Compliances: Compliance with financial regulations is critical for businesses to mitigate risks and maintain trust with stakeholders. Outsourcing firms specialize in compliance and stay updated on regulatory changes, ensuring that financial processes adhere to the latest standards. By outsourcing compliance-related tasks, companies can minimize the risk of errors, penalties, and reputational damage.

Conclusion: In today's dynamic business environment, effective decision-making is essential for sustainable growth and competitiveness. Financial outsourcing offers a strategic advantage by enabling businesses to focus on core competencies while leveraging external expertise for routine financial tasks. Ultimately, financial outsourcing empowers businesses to make informed decisions that drive success and prosperity in the long term.

Unlocking Hidden Savings: Expert Strategies for Maximizing your Tax Benefits

Dhaval Desai - Founder

-

Roth Conversions: I truly believe that Roth IRA is the most effective tax saving and wealth building which can be effectively utilized. A Roth IRA can be used as a tax-saving strategy in several ways:

If you have a year with lower than normal taxable income, you can convert some or all of your traditional IRA to a Roth IRA and pay taxes at your current (likely lower) rate You can stagger conversions over multiple years to stay within your current tax bracket each year Time conversions to years with investment losses to minimize the taxable income from the conversion.

Bracket Management : When converting to a Roth IRA, convert just enough to maximize your current tax bracket but not push you into the next higher bracket For example, if single with $150k income in the 24% bracket, you could convert $32,101 to stay in the 24% bracket.

Tax Free Growth and Withdrawals: Roth IRA earnings grow tax-free and qualified withdrawals in retirement are tax-free This provides tax-free income in retirement, which can help manage your overall tax liability.

No Required Minimum Distributions: Roth IRAs are not subject to RMDs during the original owner's lifetime This allows more tax-free growth and the ability to pass on more to heirs.

Flexibility with Contributions: You can withdraw Roth IRA contributions at any time tax and penalty-free This provides flexibility with your retirement savings.

So in summary, Roth IRA conversions, bracket management, tax-free growth, no RMDs, and flexible withdrawals make the Roth IRA a powerful tax-saving tool for many people. Consulting a tax professional can help determine if a Roth IRA strategy makes sense for your situation.

-

Changing Domicile to strategically save state tax: Its common tax saving strategy implemented to save on State Tax. Selecting a State with no income tax like Florida, Nevada, or Texas can be a strategy to reduce income taxes. Currently there are 8 States that have NO income tax at all. Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming. There are 3 States which doesn’t impose tax on 401k, IRA and Pension distributions. Illinois, Mississippi, Pennsylvania. New Hampshire only imposes an Income tax on interest and dividends.

-

Coverdell vs 529: I have a strategy to help with the tricky issue of saving for college. In the end, this approach will produce the most efficient college savings strategy by combining the best of three worlds. (1) Coverdell (2) Roth IRA (3) 529 Account. The most of stuck are with 529 as it has been marketed well and wall street have made the 529 easier to contribute and to work with. But there is no ability to control the investment, the fees are extremely high, and the returns are pitiful. On the other hand, compared to the 529, the Coverdell uses a secret weapon that makes it possible to develop a college nest egg far more quickly. It may surprise you to learn that you have the ability to "self-direct" the investments made inside your Coverdell!

Effective Strategy to be followed:

1. Start with Coverdell as it is self-directed and you can get the best rates of return on investing.

2. Use the Roth IRA to supplement college savings as Roth for your child can come out penalty and tax free while the investments inside the account continue to grow tax free.

3. Finally fund the 529 with disposable income with least amount of control and lowest returns so it comes last in the strategy. -

HSA: A powerful tool to take control of your own health care with a proactive approach HSA helps in saving taxes above the line deduction at any income level. An HSA (Health Savings Account) allows you to contribute pre-tax dollars to pay for eligible medical expenses. HSA is a Triple Tax advantaged account as Contributions to an HSA are tax-deductible, the money grows tax-deferred, and withdrawals for qualified medical expenses are tax-free. You can build and self-direct the HSA bucket with any type of investment. The Bottom line is that, an HSA is a powerful tax-advantaged account that allows you to save and pay for healthcare costs while also providing long-term investment potential to supplement your retirement savings.

-

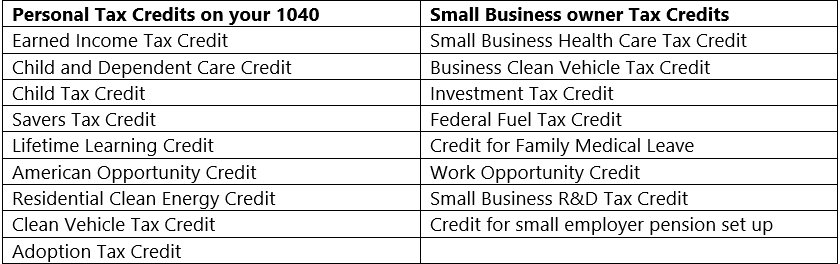

Get Acquainted with the tax credits apply to that could potentially your situation. Many citizens don't know that they could be eligible for a plethora of exciting credits. There are phase out limits if you make too much money but there are bunch of credits that may apply to your situation.

-

Establishing a Small business as a side hustle: Launching a small business stands out as an effective strategy for building personal wealth and minimizing the primary expense in our lives: taxes. Starting a small business can help save on taxes in several ways. If you are not owning small business or a rental property you will end up paying taxes and myriad of expenses (Personal Expenses) with after Tax Income. These personal expenses can be claimed against small business.

Deducting business expenses: You can deduct ordinary and necessary expenses incurred in running your business, such as office supplies, equipment, utilities, and business insurance premiums. These deductions reduce your taxable income.

Claiming start-up costs: The IRS allows you to deduct up to $5,000 in start-up costs in the first year your business is active, provided your total start-up costs are less than $50,000. Expenses beyond this limit can be amortized over 15 years.

Deducting home office expenses: If you use a portion of your home regularly and exclusively for business purposes, you may be able to deduct a percentage of your rent, utilities, and other expenses related to that space.

Deducting vehicle expenses: If you use your personal vehicle for business purposes, you can deduct a portion of your vehicle expenses, such as gas, insurance, and maintenance.

Deducting health insurance premiums: If you are self-employed, you can deduct your health insurance premiums as a business expense, which can lead to significant tax savings.

To maximize your tax savings, it's crucial to keep accurate records of your business expenses and consult with a tax professional to ensure you are taking advantage of all eligible deductions.

-

Buying Rental Properties: Short Term Rental remain a popular avenue foe additional income. Due to outdated Treasury Regulation, which were put by the IRS long before Airbnb or Vrbo, there are several ways in which tax can be determined, particularly if you don’t qualify as Real Estate Tax Professional.

Several benefit that can result from having Cash Flow producing Rental Property are as follow:

1. Tax Deferred Growth

2. Capital gain Treatment upon Sale

3. Tax Write offs and Possible Flow thru Losses that can set off other income

4. Tax Free Cash Flow

5. Exit Strategies such as 1031 exchanges etc.

-

Establishing S Corp: S Corporations offers several tax benefits that can help business owner save taxes. The Benefits of S Corp are as follows:

1. Pass Through Status: S corps are considered pass-through entities, meaning that profits and losses are directly passed to shareholders, who report them on their personal income tax returns. This eliminates double taxation, where income is taxed at both the corporate and shareholder levels.

2. Minimize Self Employment Taxes: S corps allow shareholders to receive both a reasonable salary (subject to employment taxes) and dividends (typically not subject to self-employment taxes). This can significantly reduce the total tax liability of the shareholders. Everything other than reasonable salary will flow through and not subject to SE Tax.

Therefore strategically allocating income between salary and dividends can help S corp shareholders optimize their Tax Liabilities, especially when combined with other deductions and credits available to individuals.

-

Health Care Write offs for Small Business: S Corporations offers several tax benefits that can help business owner save taxes. The Benefits of S Corp are as follows:

Small Business Owners:

Health Insurance is 100% deductible for the small business owner whereas non- business owner have to itemize would have to try and itemize on Schedule – A and the most possible scenario is you wont be able to itemize it. So its better to have a side hustle or side gig as it is considered as small business. It doesn’t matter whether health insurance premium is paid personally or paid by the small business. The Only requirement to deduct health insurance is to have “Net Income’.

Rental Property Owners:

One of the common mistake done is considering having rental property as small business and writing off health insurance against rental income reported under Schedule E. The precondition to write off health insurance is to have self-employment income reported under Schedule – C. There can be a situation where property is being managed by the employee so it is permissible to deduct health insurance pertaining to your employee as an employee benefit.

S-Corp Owners:

If you own a business and report it as S – Corp (or an LLC taxed as a S – Corp by making an election) then to get the health insurance deduction specific procedures is to be followed. First, is to recognize your business will be filling 1120S Business Tax Return and issuing a W-2 as an owner. Under Affordable health care act, they allow you to pay for your own health insurance, deduct 100% of it. If you have employees and you provide health insurance benefit in part or in full, you can deduct health insurance premium you pay for your employees except for the employee that owns 2% or more of the corporation directly on the 1120S Tax Return.

The Detailed procedure for getting the health insurance deduction for the S corp owners will be discussed separately in the Next BLOG.

-

Paying Children and Grand Kids:

Hiring your children or grandchildren to work for your business can result in significant tax savings in a few key ways:

Income Tax Savings: If you hire your child/grandchild, they will pay no federal income taxes on the first $13,850 earned in 2023. They will likely pay very little state income tax as well. For Example, if your federal tax rate is 25% and state tax is 7%, hiring your child to earn $13850 can save you approximately $4,432 in income taxes.

Payroll Tax Savings: If your business operates as a Sole Proprietorship or Partnership and you employ your minor children, you can save on Social Security, Medicare and FUTA Taxes. This can add up to an additional 15.3% in savings, for a total of around $6,651 in Tax Savings.

Roth IRA contributions: By having your children on payroll, they can contribute to a ROTH IRA with their earned income, allowing money to grow Tax Free.

To maximize the Tax benefits, ensure the pay is reasonable, the children are suitable for the jobs and keep detailed records of hours worked and duties performed. Keep in consideration child Labour Laws and any state specific regulations while employing children and grand kids. While hiring grandchildren directly is not allowed by the IRS, there may be a workaround by paying them through a parent owned management company.

There are many more other strategies that can be put in place to significantly save tax which will be discussed in upcoming BLOGS.